Understanding the QRMP Scheme for Small Taxpayers, Get Practical GST Course in Delhi, 110008, by SLA Consultants India, New Delhi

The QRMP (Quarterly Return Monthly Payment) Scheme under the Goods and Services Tax (GST) regime is designed specifically for small taxpayers with an annual turnover of up to ₹5 crores. Introduced to ease the compliance burden on small businesses, the QRMP scheme allows businesses to file GST returns quarterly while making monthly payments.

Key Features of the QRMP Scheme:

Quarterly Return Filing: Taxpayers enrolled in the QRMP scheme can file their GST returns on a quarterly basis. This is different from the regular monthly return filing system. The quarterly return filing under the scheme is done through GSTR-3B and GSTR-1 forms, where:

GSTR-3B is a summary return that needs to be filed for the respective quarter, showing the details of output and input tax.

GSTR-1 is the outward supply return and needs to be filed quarterly as well, listing the sales made by the business.

Monthly Payment of Tax: While the returns are filed quarterly, businesses must make monthly tax payments under the QRMP scheme. This is done by filing GST PMT-06, which involves the payment of tax through challan. Taxpayers are required to make monthly payments based on the estimated tax liability.

Simplified Compliance: The scheme reduces the frequency of return filing for small businesses, thus minimizing the compliance burden. Instead of filing returns monthly, small businesses now have to file only four returns annually for the same set of transactions, while still paying taxes monthly.

Optional Scheme: The QRMP scheme is optional for taxpayers with an annual turnover between ₹1.5 crores and ₹5 crores. Taxpayers can choose to opt-in for the scheme based on their business requirements and preferences. If the turnover exceeds ₹5 crores, businesses must revert to the regular monthly filing system.

Auto-Drafted GSTR-3B: The government has implemented a system where the GST returns, specifically GSTR-3B, are auto-drafted based on the data from previous returns. This reduces the chances of error and ensures better accuracy in the tax filing process.

Increased Ease of Doing Business: By simplifying the return filing process and making it quarterly rather than monthly, the QRMP scheme helps reduce the burden of regular filing for small businesses, particularly those with limited resources. It enhances the ease of doing business and encourages compliance with GST provisions.

Eligibility: To be eligible for the QRMP scheme, a business must have an aggregate turnover of less than ₹5 crores in the previous financial year. This scheme is available to both Goods and Service taxpayers but excludes businesses that deal with non-GST supplies like those selling exempt goods.

Benefits of QRMP Scheme:

Reduced Filing Frequency: Small businesses can file returns just once every quarter.

Simplified Tax Payment: Monthly payments instead of monthly filings.

Tax Calculation Made Easy: With the auto-drafted return system, taxpayers can reduce their workload in tax filing.

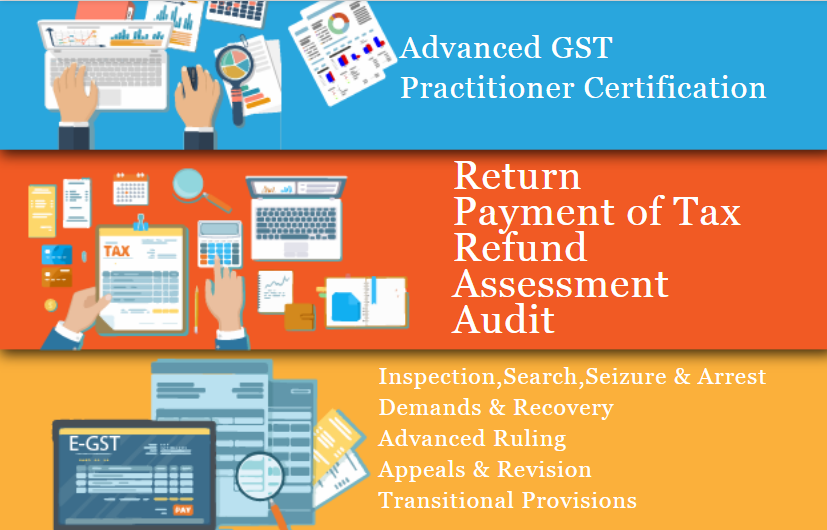

SLA Consultants India – Practical GST Course in Delhi:

If you’re looking for professional training on GST compliance, the Practical GST Course in Delhi, offered by SLA Consultants India, provides an in-depth understanding of GST, including the QRMP scheme, filing returns, and monthly payments. The course is designed for beginners and professionals who wish to understand GST from a practical perspective. It covers everything from registration to filing returns and payments under various schemes like QRMP. Located in New Delhi (110008), SLA Consultants India offers expert guidance, hands-on training, and case studies that help you become proficient in GST compliance.

By taking this course, you’ll gain essential knowledge and practical skills, making you adept at managing your business’s GST requirements and helping your company stay compliant.

SLA Consultants Understanding the QRMP Scheme for Small Taxpayers, Get Practical GST Course in Delhi, 110008, by SLA Consultants India, New Delhi Details with “New Year Offer 2025” are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 5 – Customs / Import and Export Procedures – By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi – 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/